Proxy Voting

As a long-term shareowner, we view proxy voting as one of the primary tools to influence a company's operations and corporate governance practices. That's why it's important for shareowners like us to vote our proxies based on the full understanding of publicly available information.

We vote our proxies in accordance with our Governance & Sustainability Principles, and publicly post our votes in advance of each company's shareowner meeting.

Governance & Sustainability Principles

As part of the Total Fund Policy adopted by the CalPERS Board’s Investment Committee, we have a set of Governance and Sustainability Principles. For more information on our proxy voting, read CalPERS Governance & Sustainability Principles (PDF).

Proxy Voting Guidelines

Our proxy voting guidelines provide an overview of our general philosophy and approach to the most important and commonly presented proxy voting items. Our proxy voting guidelines should be read in conjunction with CalPERS’ Governance & Sustainability Principles. We vote our proxies in a manner consistent with these principles and in the interests of our beneficiaries. Read more about our Proxy Voting Guidelines (PDF) and Executive Compensation Analysis Framework (PDF).

Notable Proxy Votes

We publish Notable Proxy Votes to encourage other shareowners to vote in accordance with us. All votes are provided for informational purposes only and don’t constitute investment advice.

Proxy Solicitations

We conduct proxy solicitations on shareowner proposals that either we file or that are aligned with our initiatives. You can access our proxy solicitations at the U.S. Securities and Exchange Commission website.

Vote Disclosure

We publish our proxy voting decisions to encourage shareowners to vote in accordance with us. These votes are for informational purposes only and not intended as investment advice.

To access a record of our proxy votes since January 1, 2015, visit Global Proxy Voting Decisions.

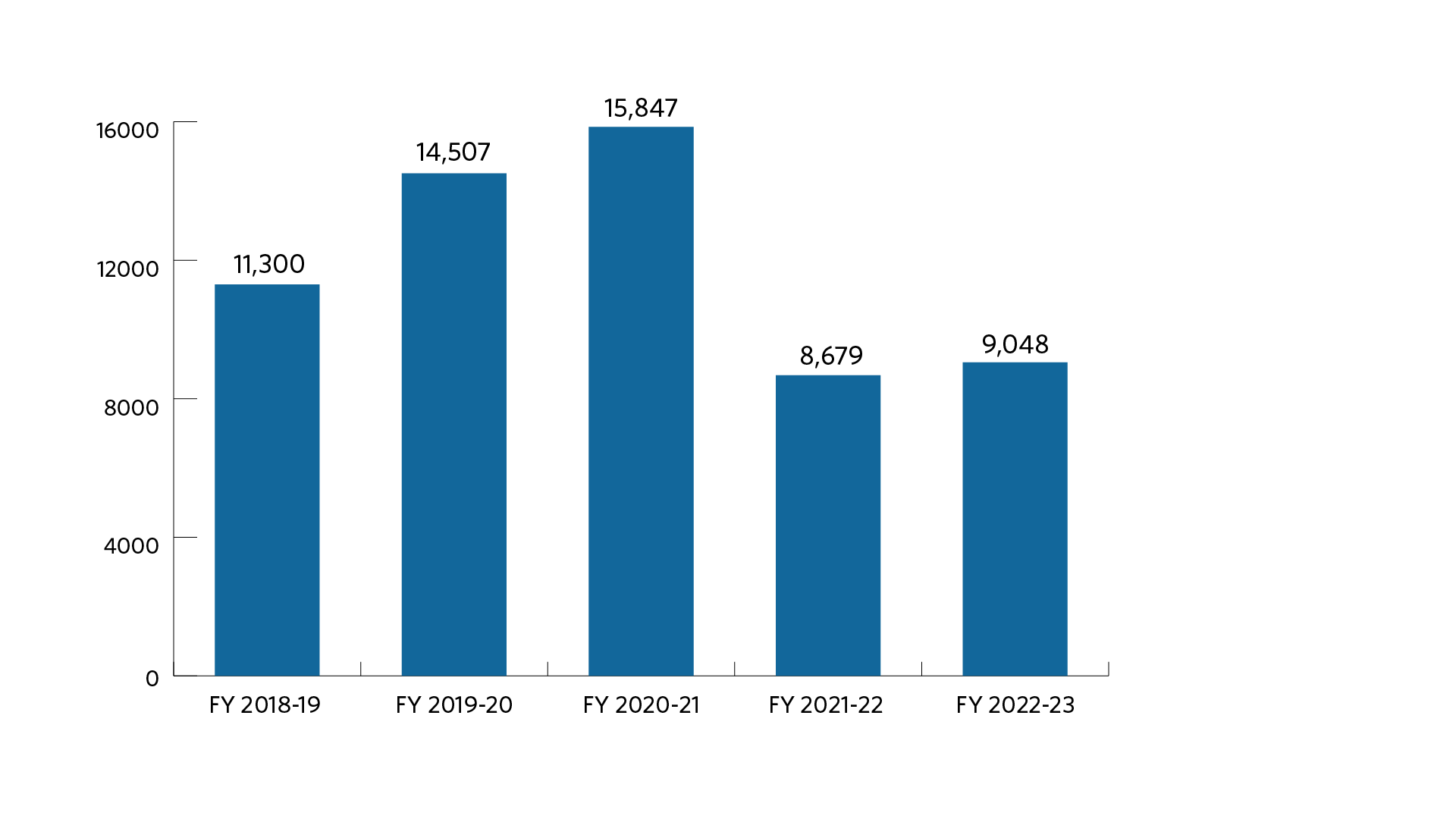

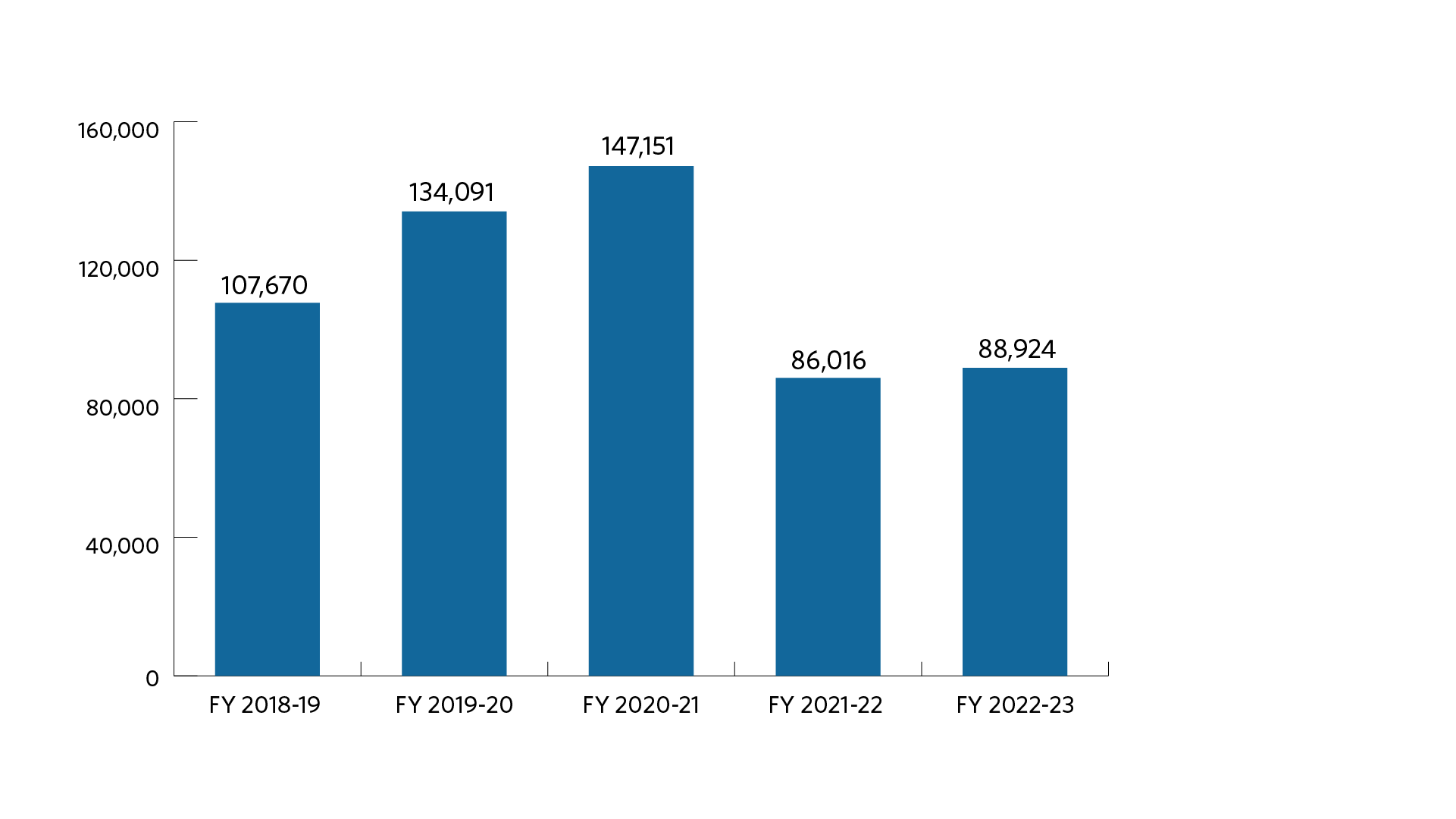

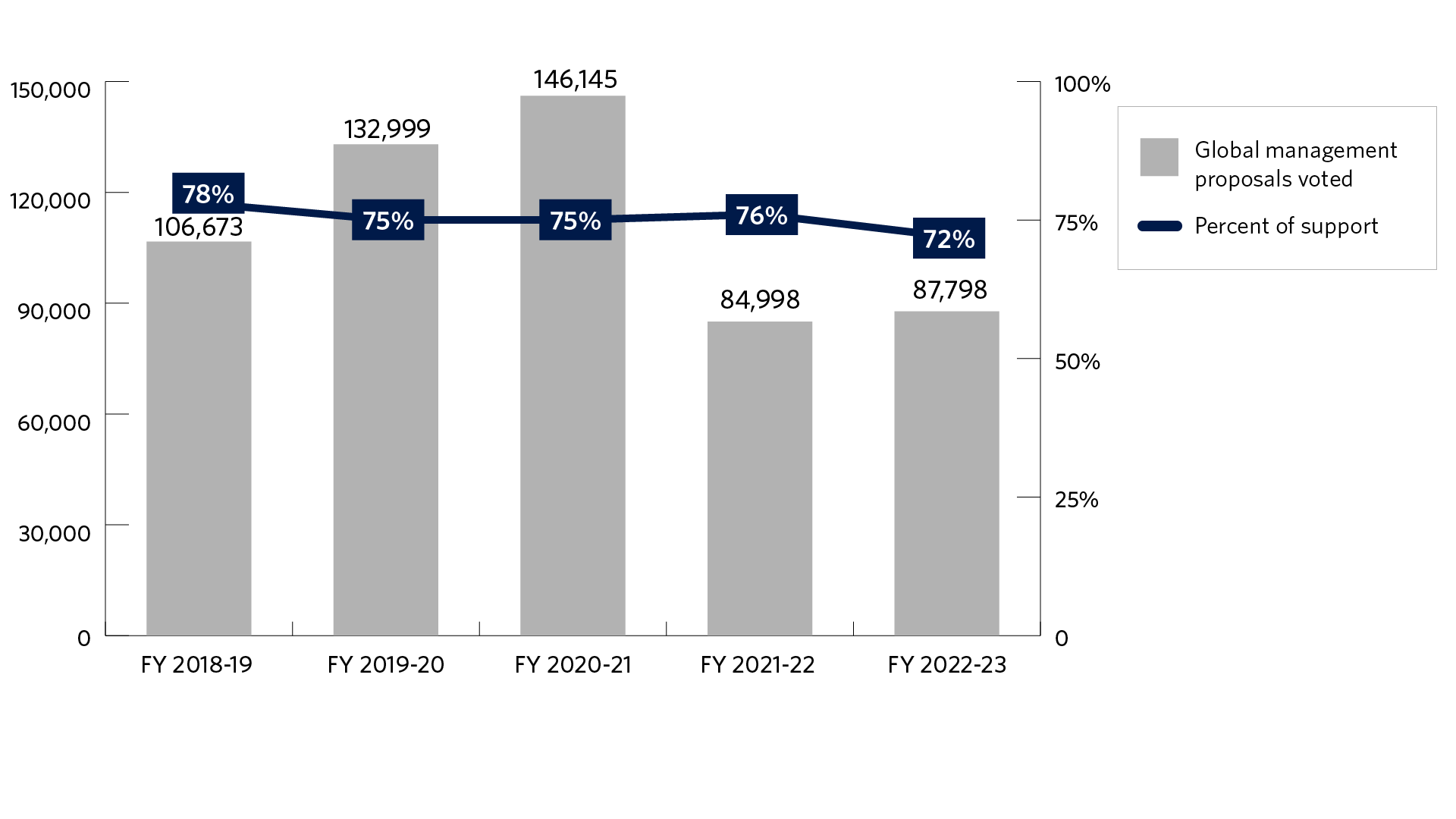

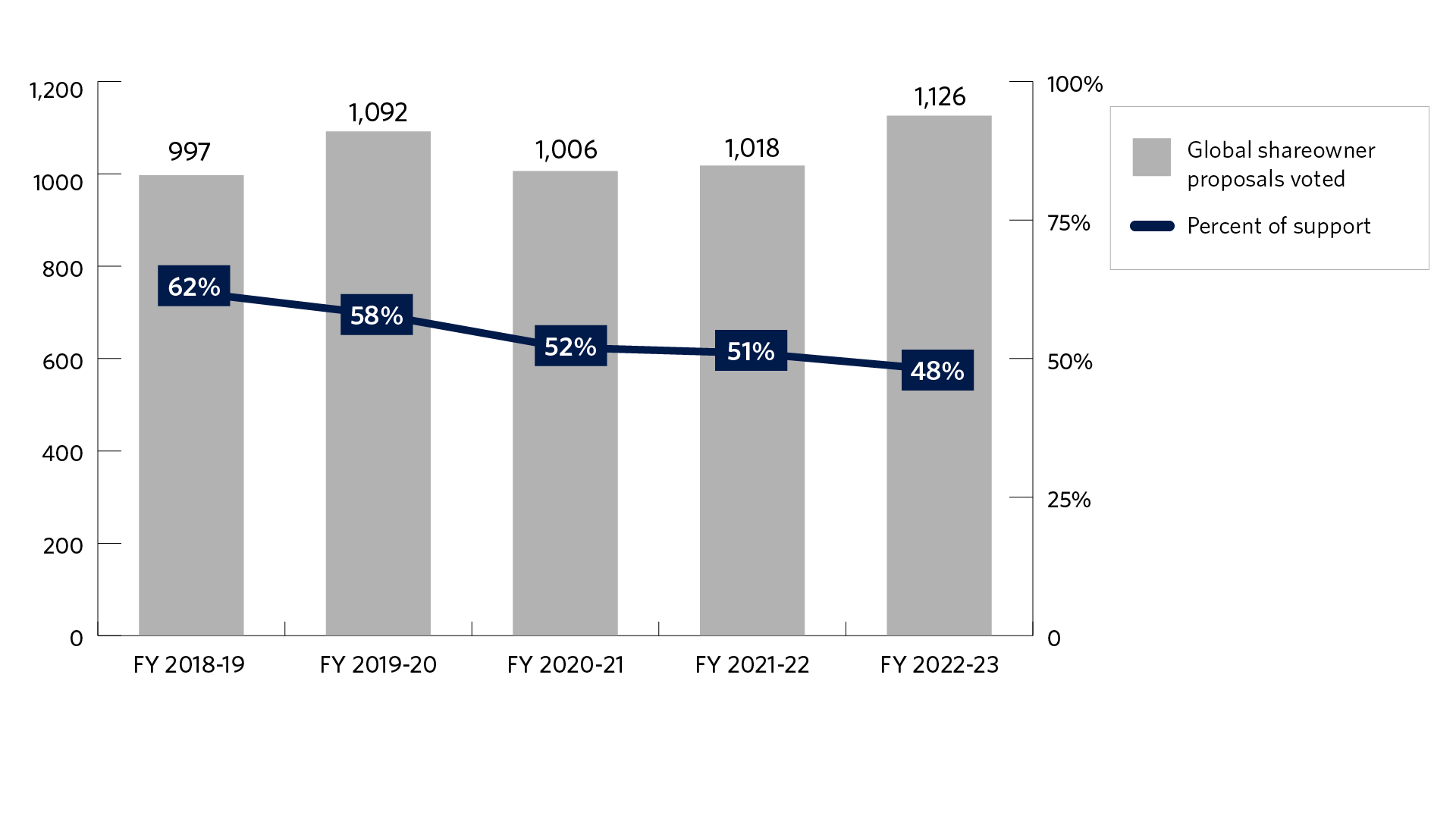

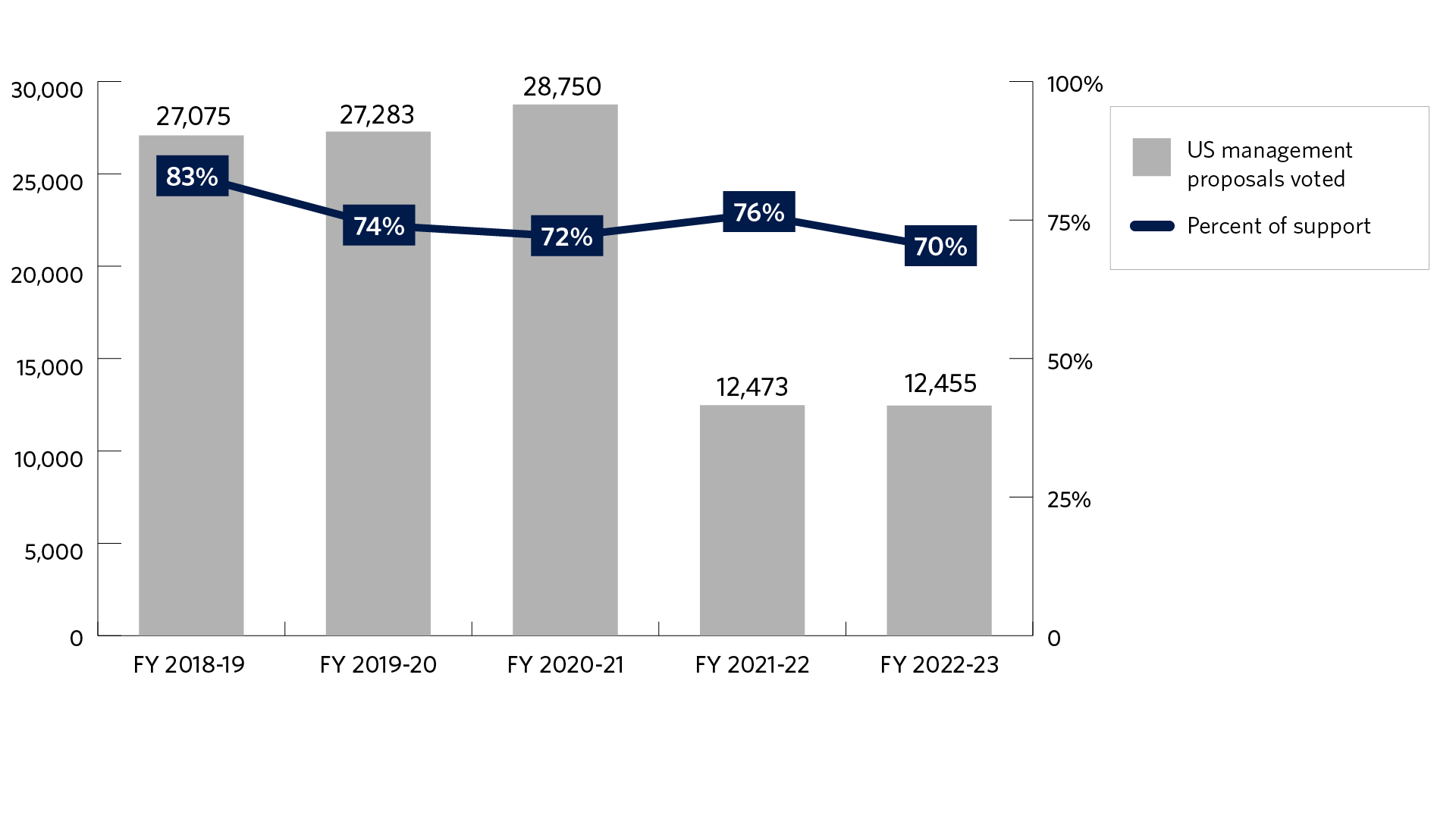

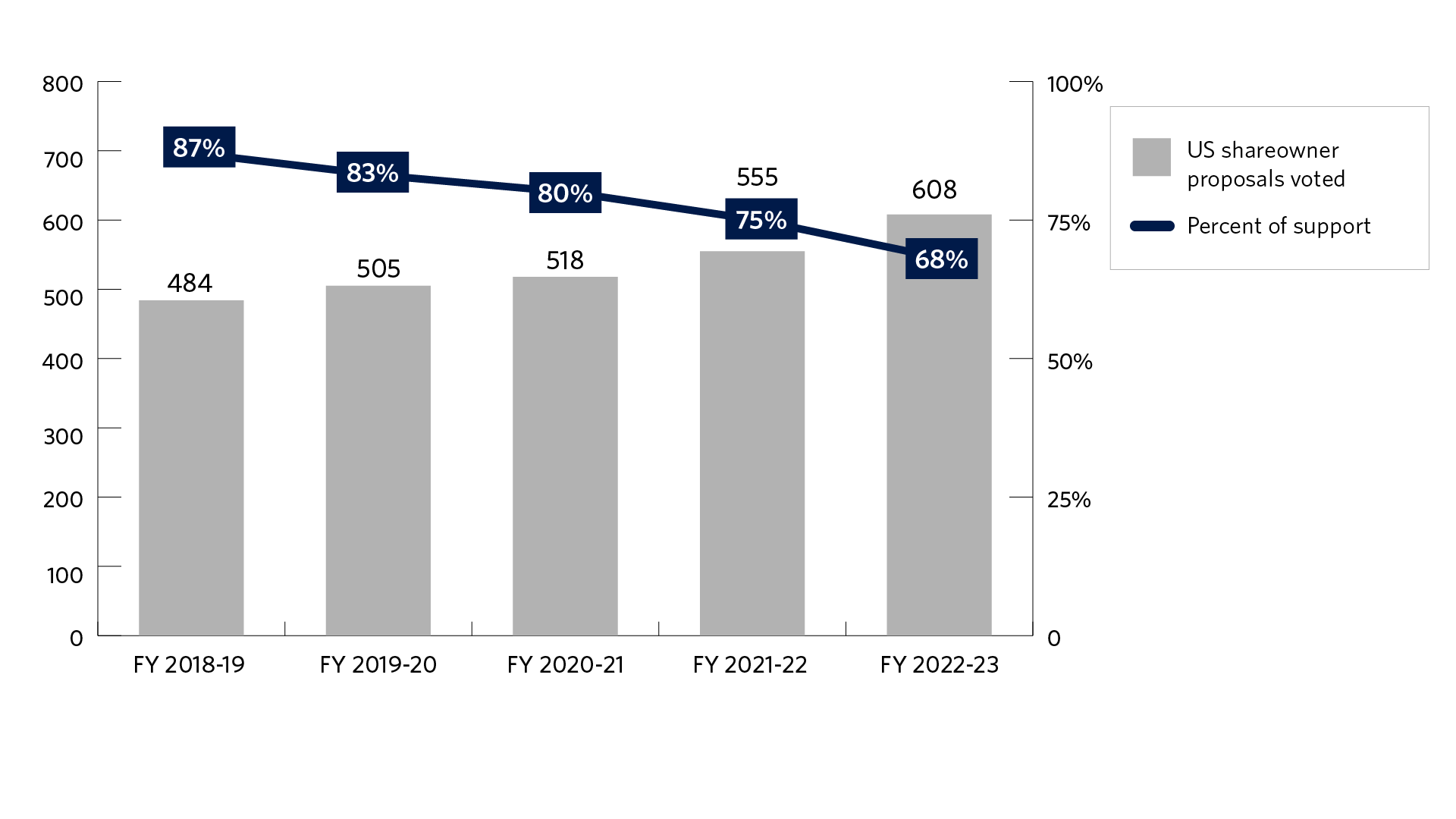

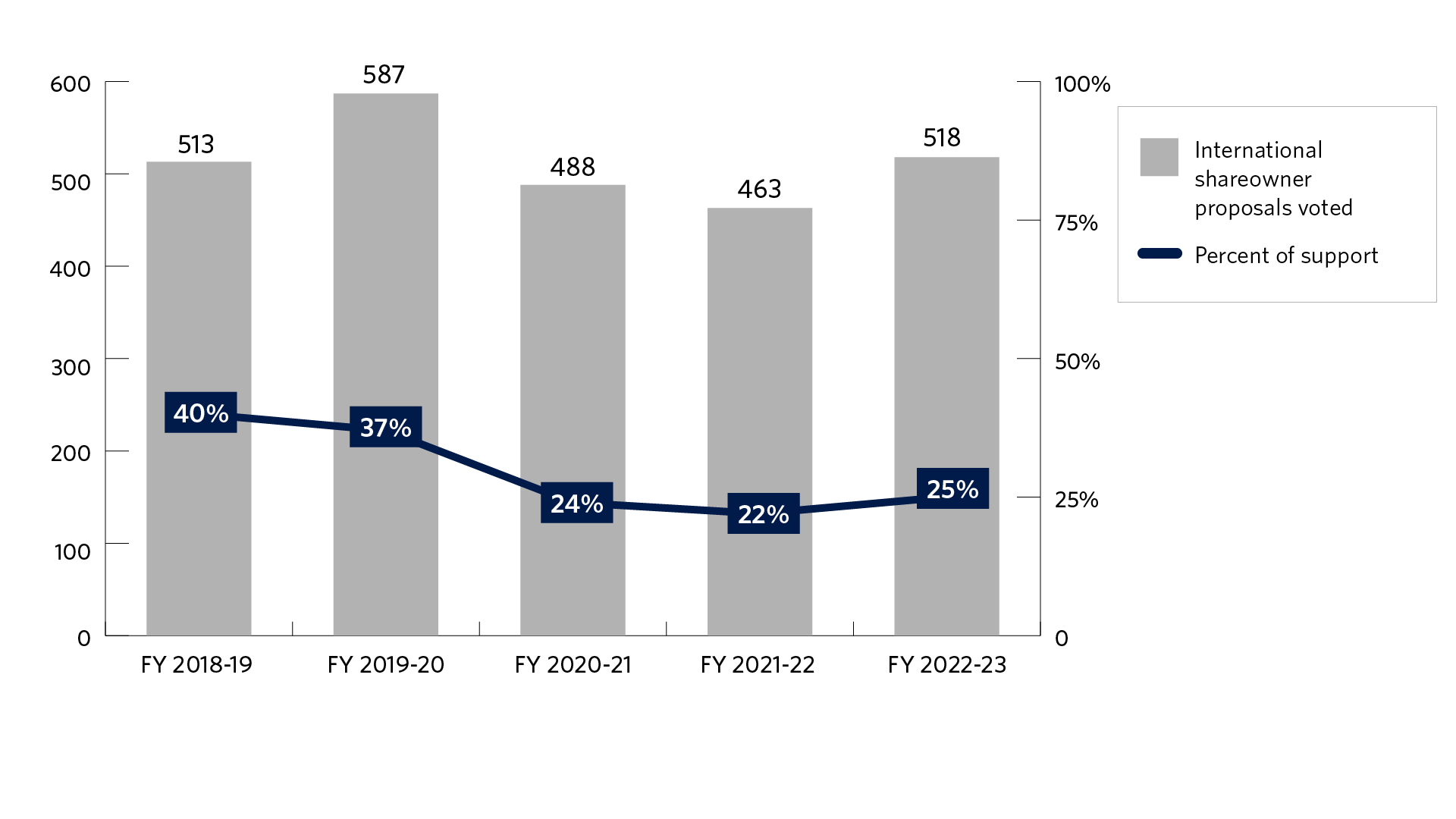

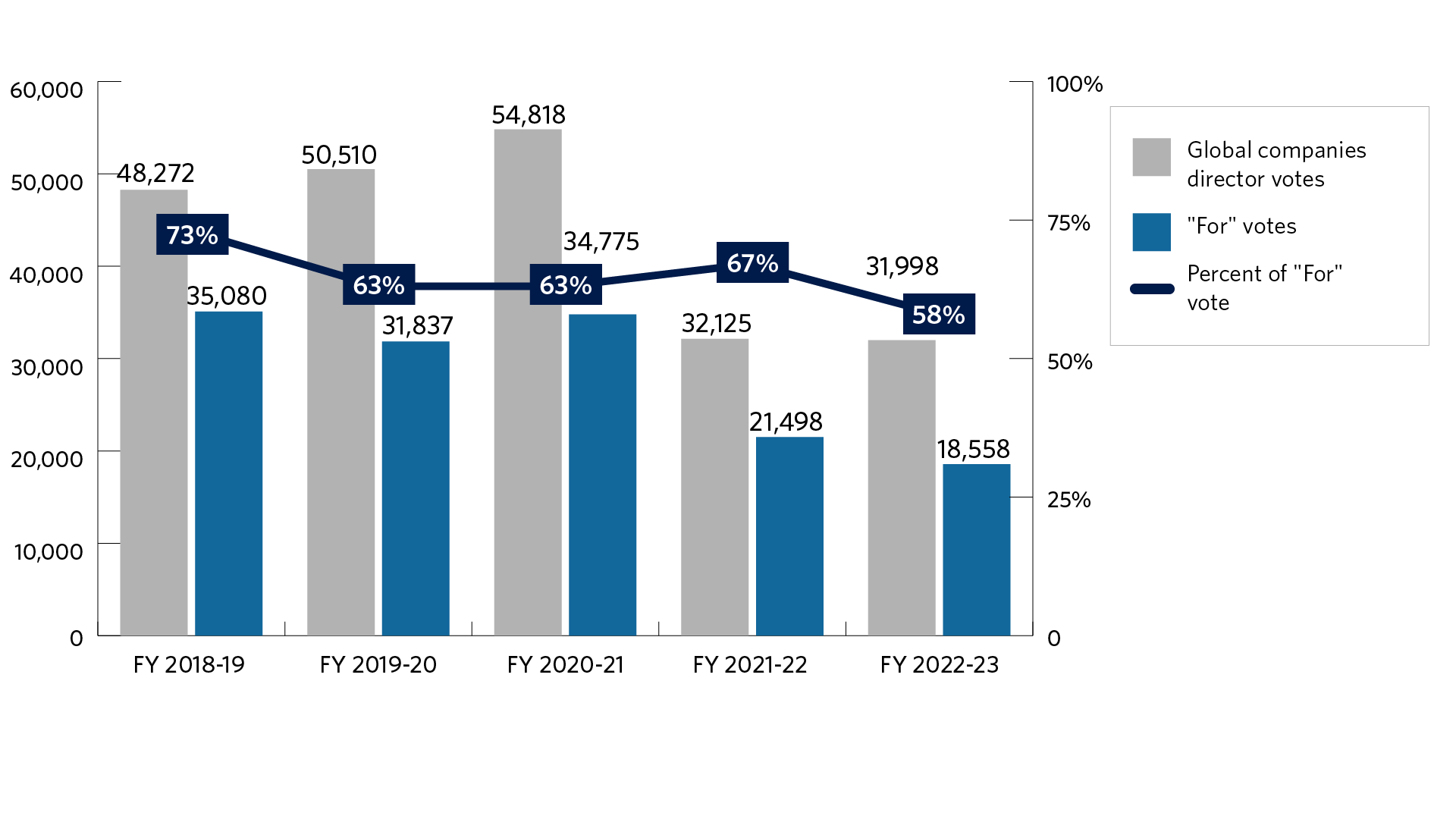

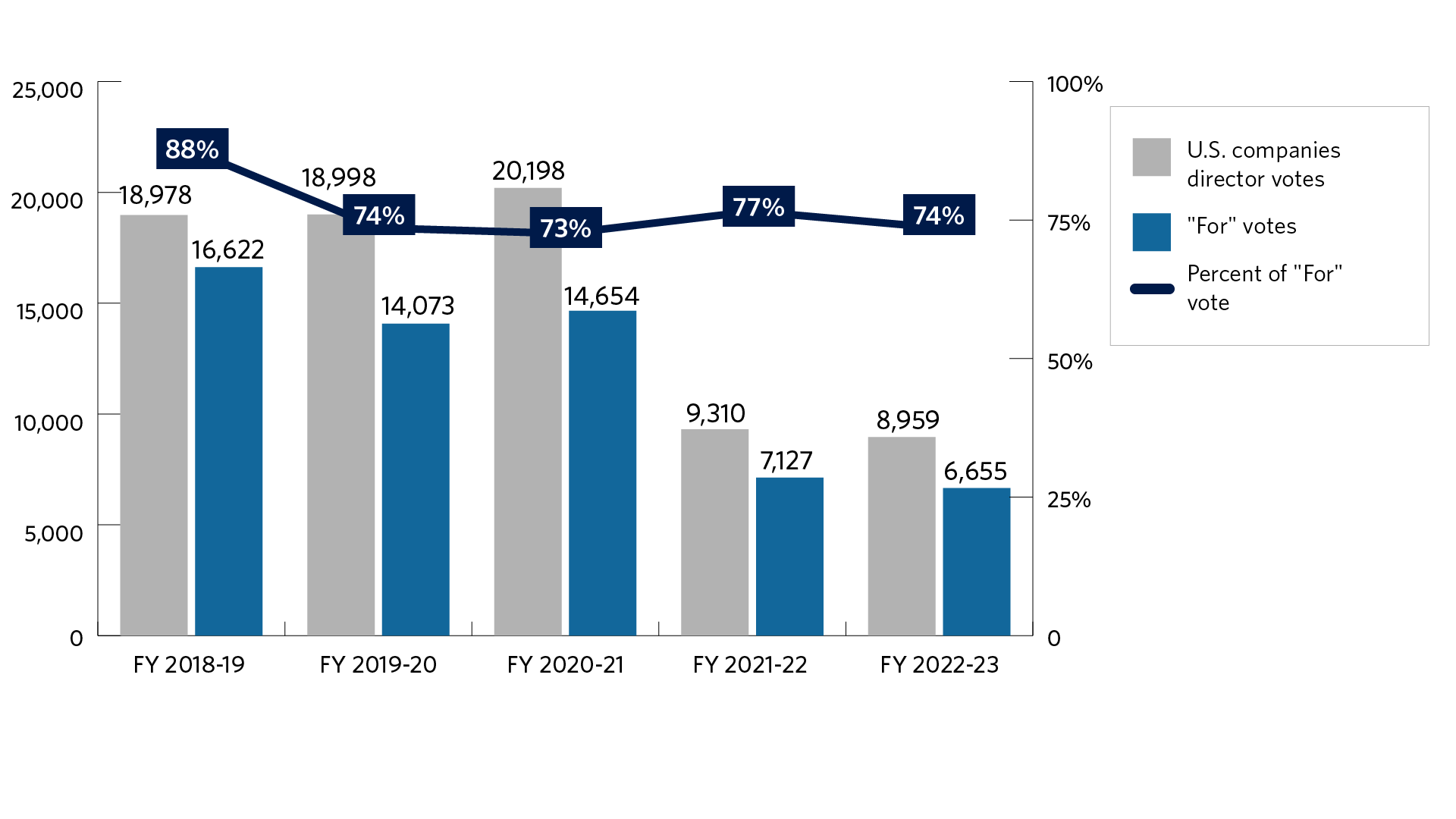

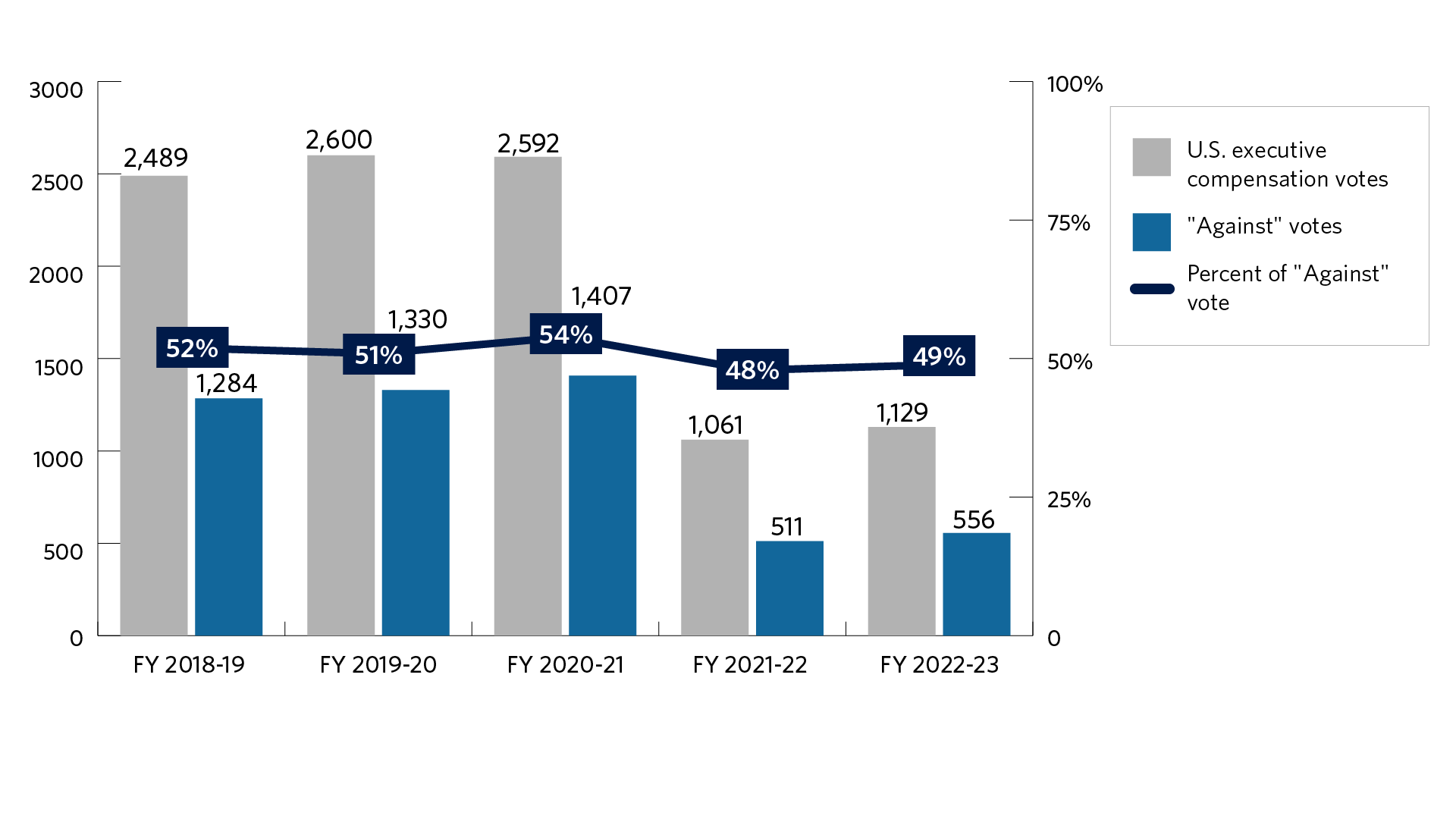

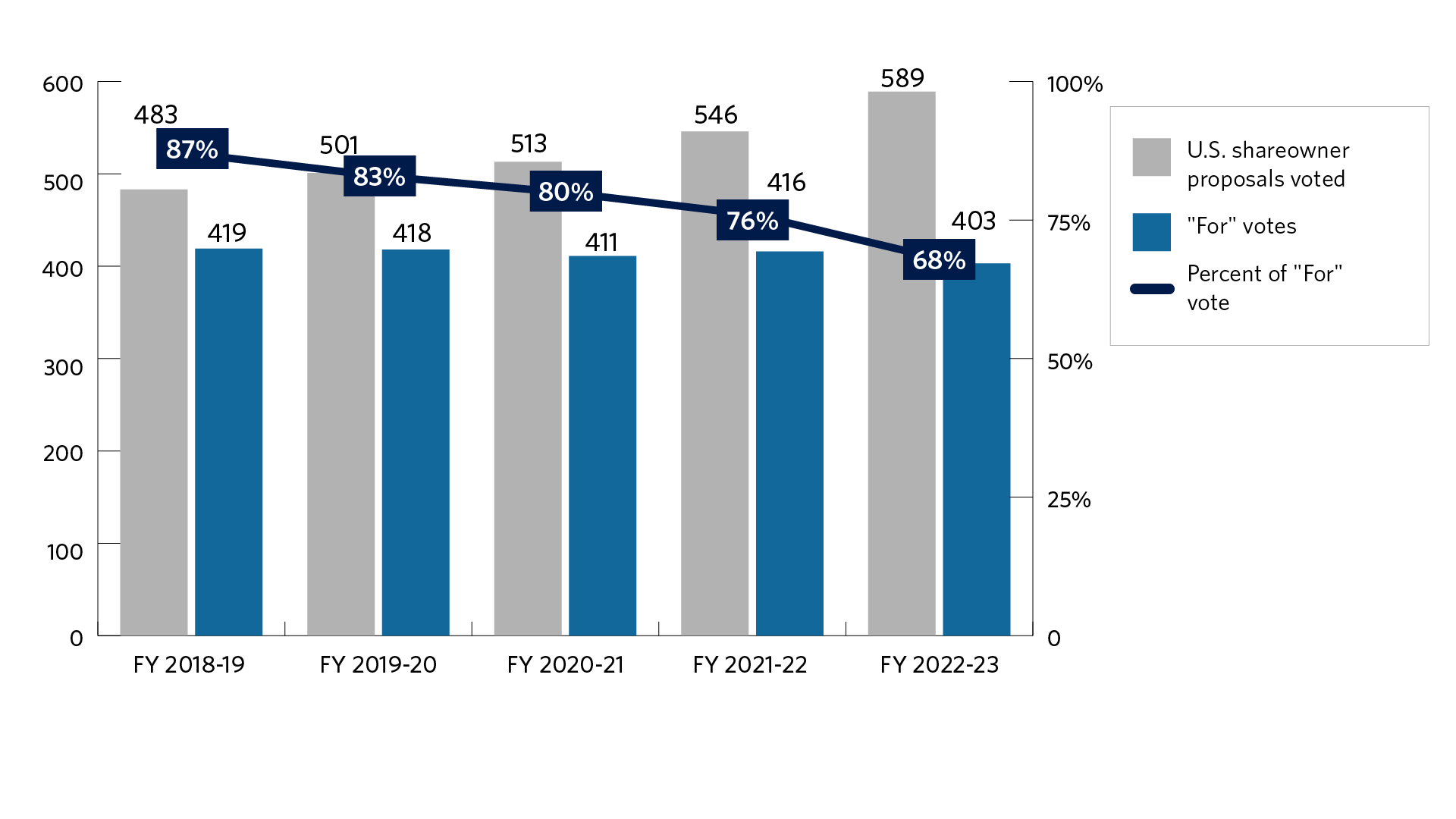

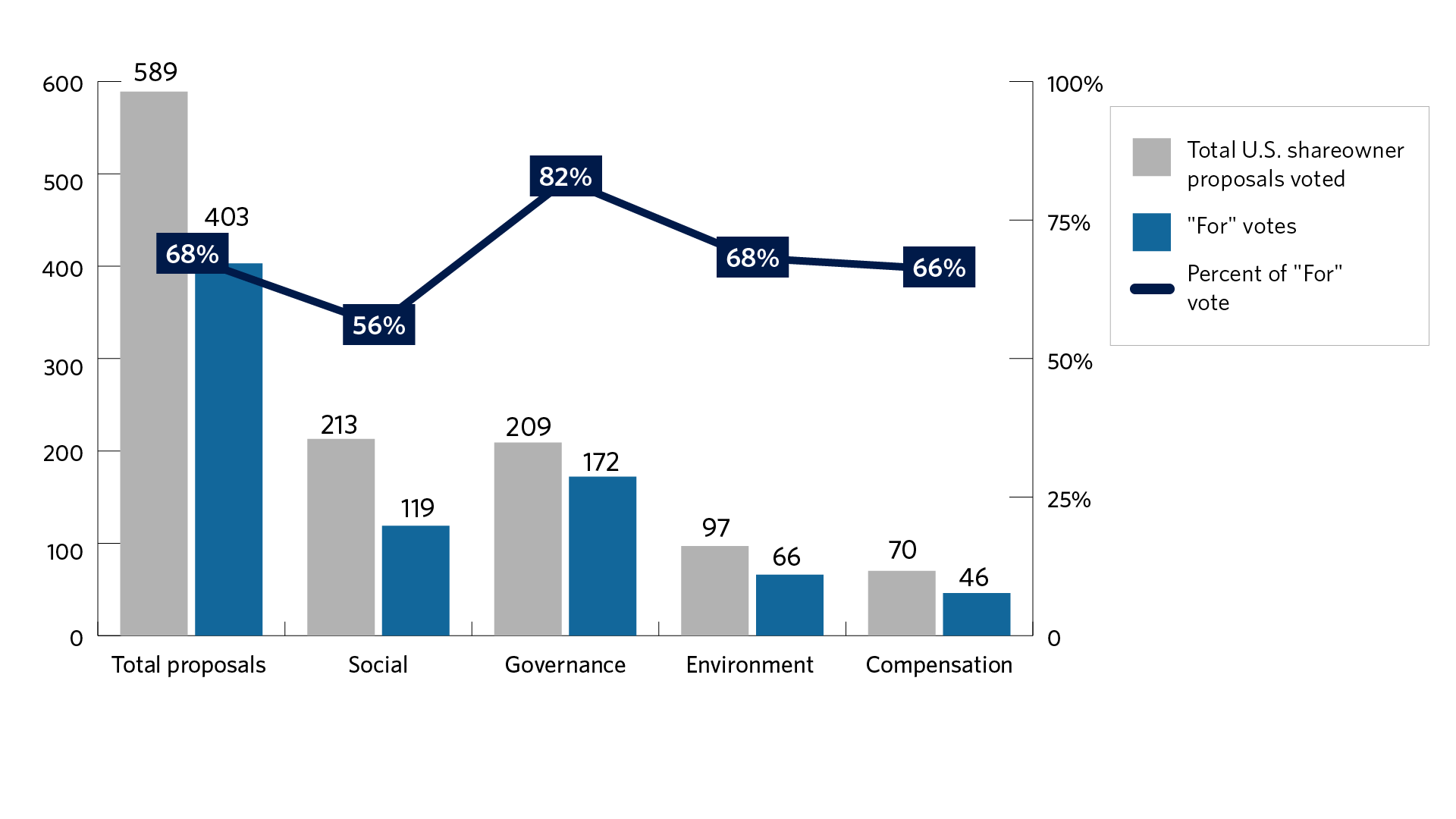

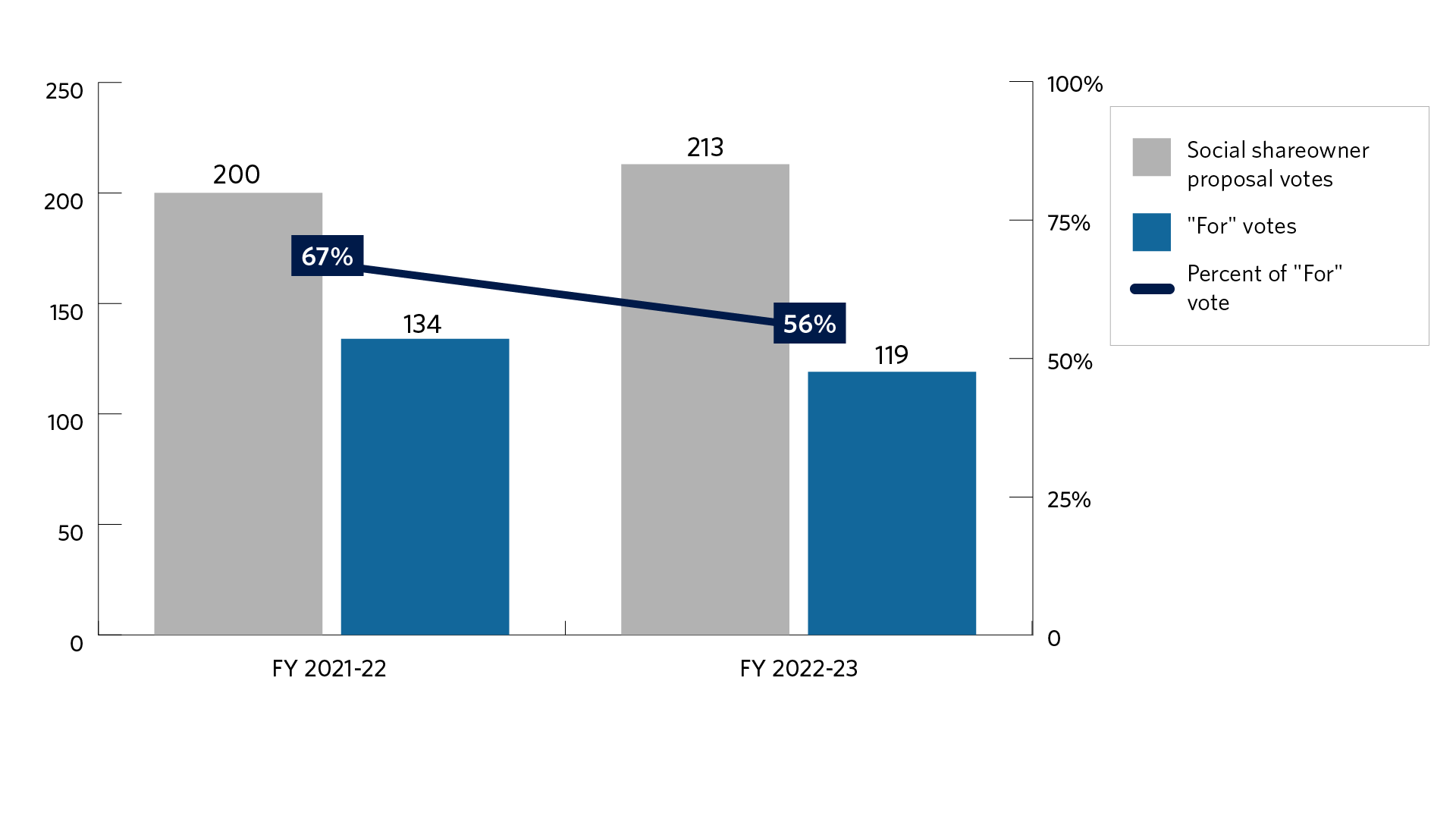

Below are our proxy voting trends over the past five fiscal years:

| Proposal | Proposals (count) | Votes For (count) | Votes For (percent) |

|---|---|---|---|

| Reviewing Political Spending or Lobbying | 54 | 44 | 81% |

| Human Capital Management | 30 | 16 | 45% |

| Racial Equity Audit | 22 | 10 | 45% |

| Reporting on Company's Compliance with International Human Rights Standards | 22 | 19 | 86% |

| Drug Pricing/Distribution | 11 | 5 | 45% |

| Animal Welfare | 10 | 4 | 40% |

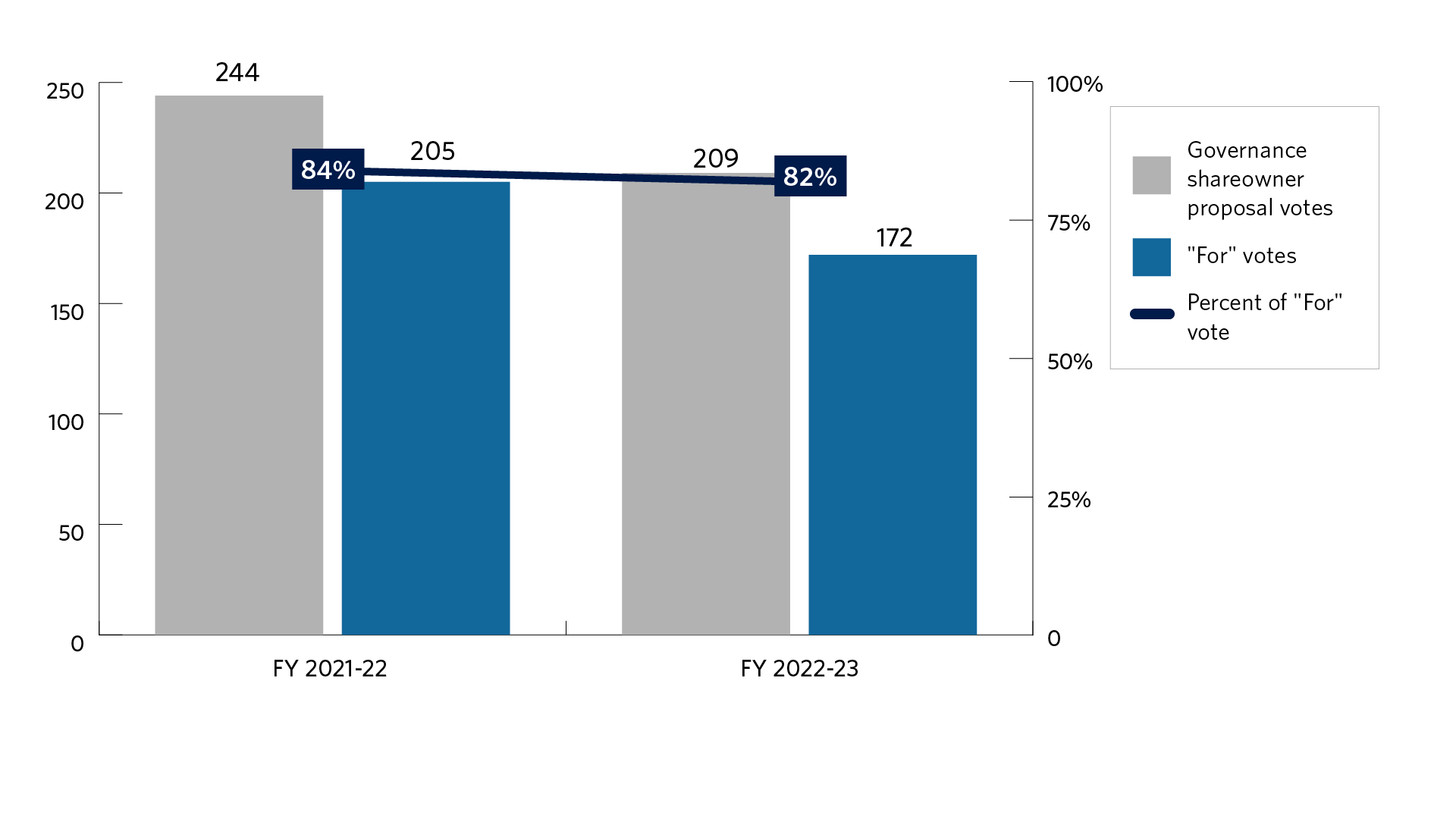

| Proposal | Proposals (count) | Votes For (count) | Votes For (percent) |

|---|---|---|---|

| Independent Board Chairman/Separation of Chair and CEO | 80 | 73 | 91% |

| Right to Call a Special Meeting | 36 | 32 | 89% |

| Eliminating Supermajority Provisions | 13 | 13 | 100% |

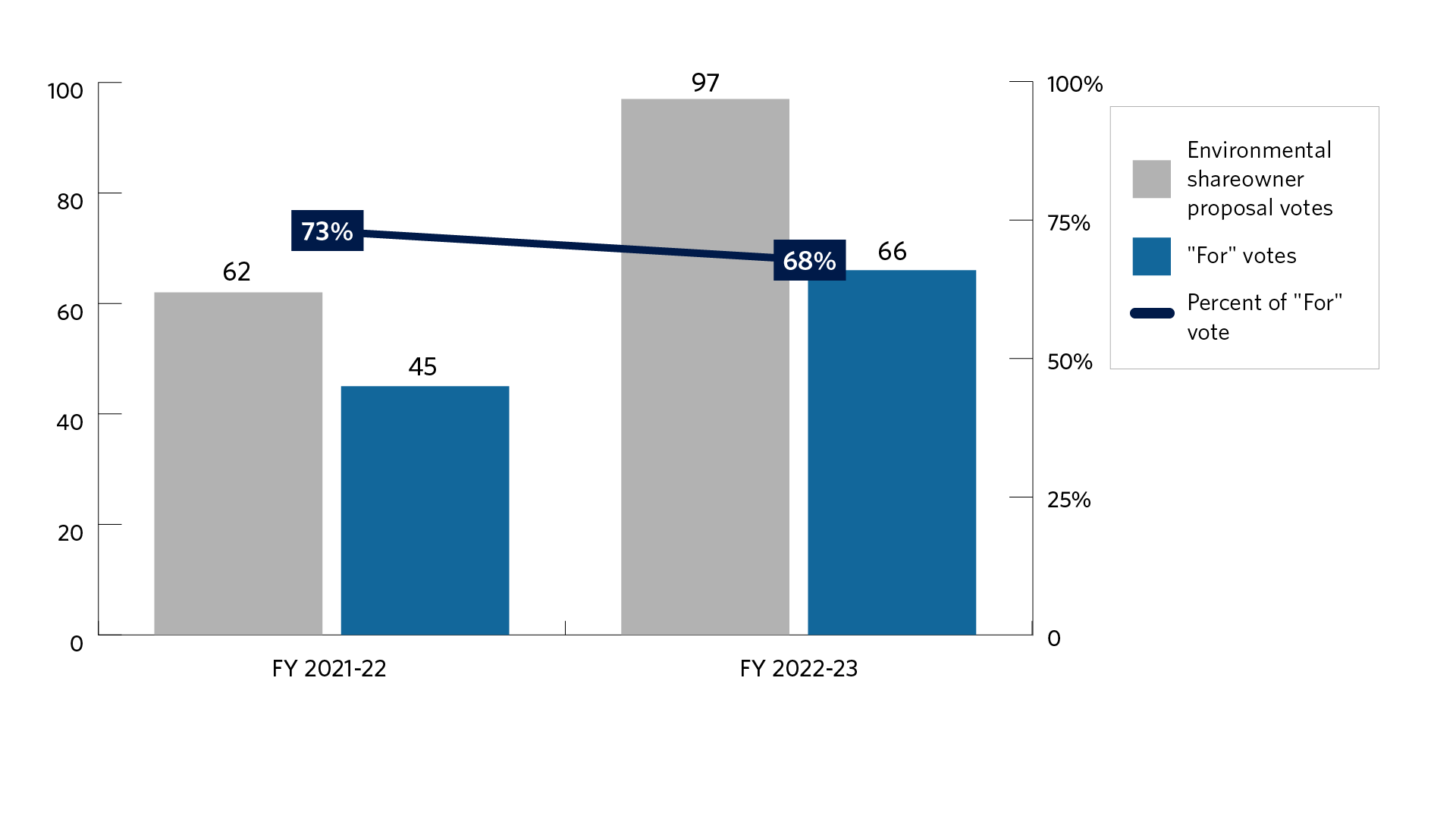

| Proposal | Proposals (count) | Votes For (count) | Votes For (percent) |

|---|---|---|---|

| Report/Action on Climate Change | 32 | 15 | 47% |

| Reporting and Reducing Greenhouse Gas Emissions | 28 | 28 | 100% |

| Environmental Report | 14 | 10 | 71% |

| Climate Lobbying | 11 | 11 | 100% |

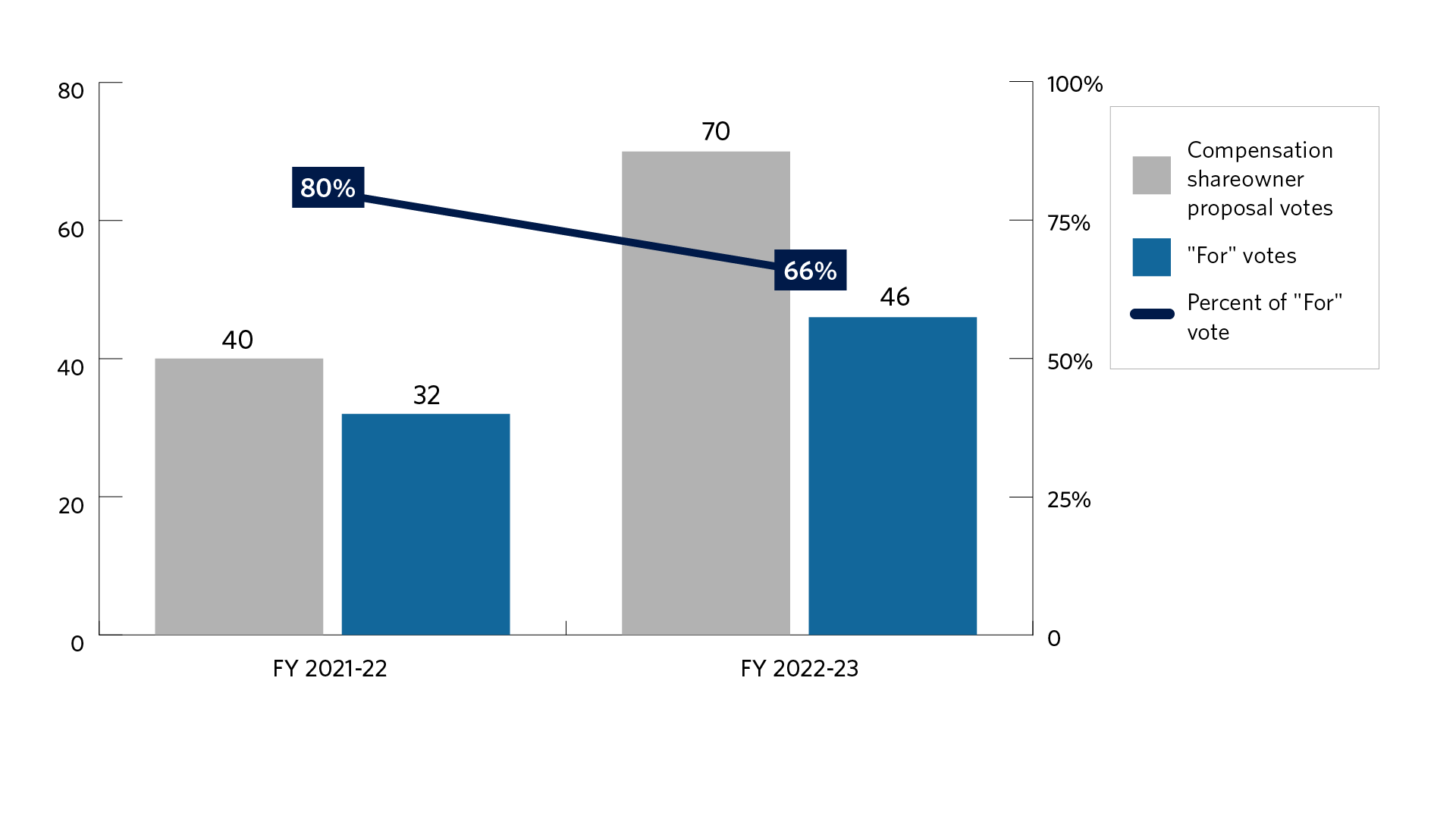

| Proposal | Proposals (count) | Votes For (count) | Votes For (percent) |

|---|---|---|---|

| Regarding Golden Parachutes | 38 | 21 | 55% |

| Race and/or Gender Pay Equity Report | 10 | 10 | 100% |

| Restricting Executive Compensation | 10 | 9 | 90% |

Corporate Governance

- About Us

- Corporate Engagement

- Proxy Voting