Managing Investments for Sustainable Returns

All investments have risks. We have a fiduciary duty to minimize risk in our portfolio and take advantage of opportunities on behalf of our 1.9 million members.

We can help maximize returns by staying informed about potential threats to certain industries or geographic areas. One example of the risks that our investments face comes from catastrophic climate events that could negatively impact our real estate holdings.

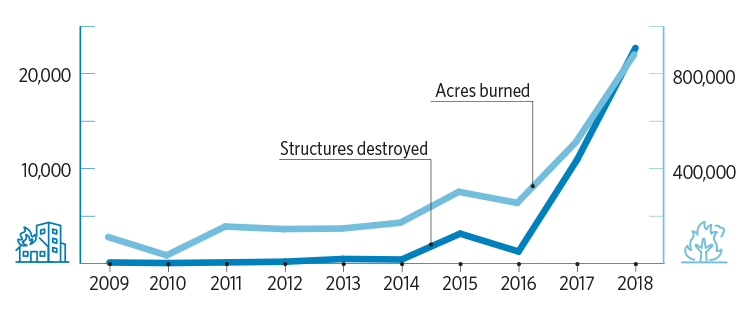

California is now experiencing wildfires year-round, with both fire damage and insurance costs continuing to rise. California Climate Change Assessment predicts that by 2055 wildfire insurance costs will rise by 18%.

Source: CalFire

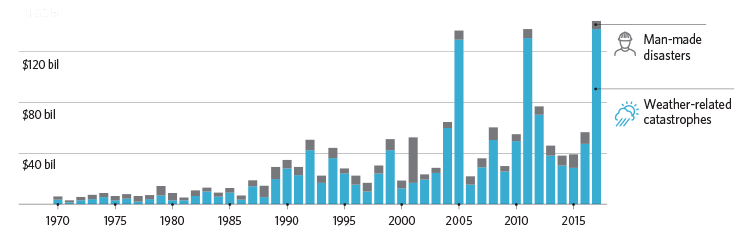

Weather-Related Insured Catastrophe Losses Are Rising Worldwide (at 2017 prices)

Source: Swiss Re Institute

What Is CalPERS Sustainable Investing Strategy

It is a risk minimizing tool. We manage potential risks to our investments throughout our portfolio and across all asset classes. These risks can include climate change, poor workforce management, or an ineffective board of directors.

It allows us to focus on returns. Minimizing risks to investments and avoiding potential risks and identifying attractive opportunities is an important and strictly financially motivated process for protecting the fund and making sound investments.

It provides a foundation for engagement. We engage with companies over issues that we believe can negatively impact a company's bottom line. By engaging, as an owner of the company, we use our voice to motivate change.

How CalPERS Achieves Its Sustainable Investing Goals

- Advocacy — Working with financial market regulatory organizations like the SEC, we advocate for standards that protect investors like CalPERS, as well as enhancing corporate reporting on subjects like board and workforce diversity, and climate risk.

- Integration — The Energy Optimization initiative involves maximizing the energy efficiency of existing CalPERS real estate assets to improve the long-term value of the buildings.

- Engagement — The Climate Action 100+ initiative is a collaboration of investors worth $32 trillion from all over the world engaging with the world's largest greenhouse gas emitters to curb emissions and strengthen climate related financial disclosures.

- Research — We are working with scientists to learn which geographic areas could be at risk to climate related incidents.