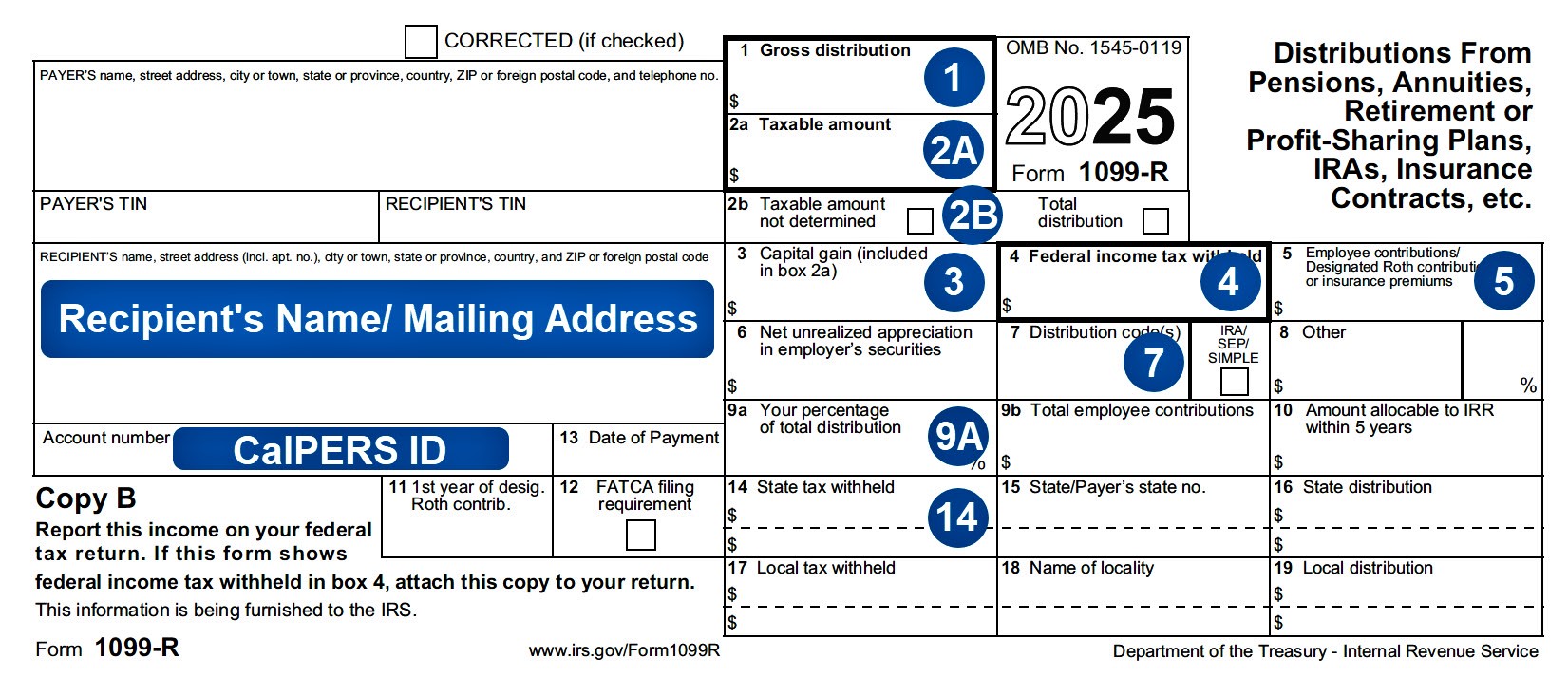

Understanding Your 1099-R Tax Form

The 1099-R tax form reports the amount of income you received during the tax year. The form contains boxes you will need to use to complete your federal and state tax returns. The 1099-R tax forms are mailed by the end of January each year and available to access and download online by logging in to myCalPERS.

Here’s a detailed description of the information you’ll be provided:

Boxes

This is the total dollar amount of the benefits you received before any deductions were withheld.

This shows the amount of your benefits that are taxable.

An “X” is present if benefit payments started July 2, 1986, through December 31, 1986, when federal and state law were using two different methods for determining the taxability of benefits.

An "X" indicates the recipient received the entire amount of the death benefit lump sum distribution.

This amount represents the portion of a taxable death benefit lump sum distribution that is subject to capital gains treatment.

This is the amount of federal income tax that was withheld from your gross distribution.

This is the annual tax-free amount of your benefit. This is based upon contributions or payments you made to the Internal Revenue Service (IRS) while working, if any.

This code indicates the type of benefit being reported to IRS:

| Distribution Code | Benefit Type |

|---|---|

1 | Early distribution, no known exception: Partial service retirement distribution being paid to a member who is under age 59 1/2 on December 31 of the tax year being reported. |

2 | Early distribution, exception applies: Service retirement or pre-retirement death benefit distribution being paid to a member who is under 59 1/2 on December 31 of the tax year being reported. |

3 | Disability retirement or pre-retirement special death distribution. |

4 | Death benefit lump sum (or 1959 survivor rollover) distribution made to a decedent's beneficiary or survivor, including their trust or estate. |

4a | Indicates the amount reported is a death benefit lump sum distribution which may be eligible for the 10-year tax option method of computing the tax. |

4b | Indicates the amount reported is a death benefit lump sum distribution which may be subject to the death benefit exclusion Note: The death benefit exclusion was repealed for death dates after August 20, 1996. |

4c | Indicates the amount reported is a death benefit lump sum distribution which may be eligible for taxability provisions under distribution codes 4a and 4b. |

4g | Indicates the amount reported is a death benefit distribution which was a direct rollover distribution to a tax-sheltered annuity or an individual retirement account (IRA). |

G | Direct rollover of a distribution to a qualified plan or an IRA. |

7 | Normal distribution. Service retirement or pre-retirement death monthly benefit distribution being paid to a participant who is at least 59 1/2 on December 31 of the tax year being reported. |

This indicates what percentage of the entire benefit you received when a death benefit lump sum distribution is paid to more than one beneficiary. We can’t divulge the names of any other beneficiaries who may have received a portion of the benefit.

If you received the entire distribution, there will be an "X" in Box 2b.

This is the total amount of California state income tax that was withheld from your gross distribution.

This is the mailing address that we currently have on file for you as of December 31. If you’d like to verify your address, log in to myCalPERS. If you don’t have an account yet, visit using myCalPERS to find out how to register.

The first ten digits of this account number are your unique CalPERS ID, which is provided to the IRS for account-processing purpose.

Disclaimer

This information isn't intended as tax advice. For more information, contact a professional tax adviser, the Internal Revenue Service or California Franchise Tax Board.