CalPERS’ Proxy Voting Holds Global Companies Accountable for Climate-Related Risks, Board Independence, and Executive Compensation

February 15, 2024

Communications & Stakeholder Relations

Office of Public Affairs

(916) 795-3991 - newsroom@calpers.ca.gov

SACRAMENTO, Calif. – The California Public Employees’ Retirement System (CalPERS) continued its efforts in 2023 to hold companies it invests in accountable in several critical areas including: director accountability, board independence, executive compensation, and oversight of climate-related risks.

The newly released 2023 Proxy Season Wrap-Up (PDF) provides insight into how CalPERS voted in nearly 32,000 elections. Among the highlights:

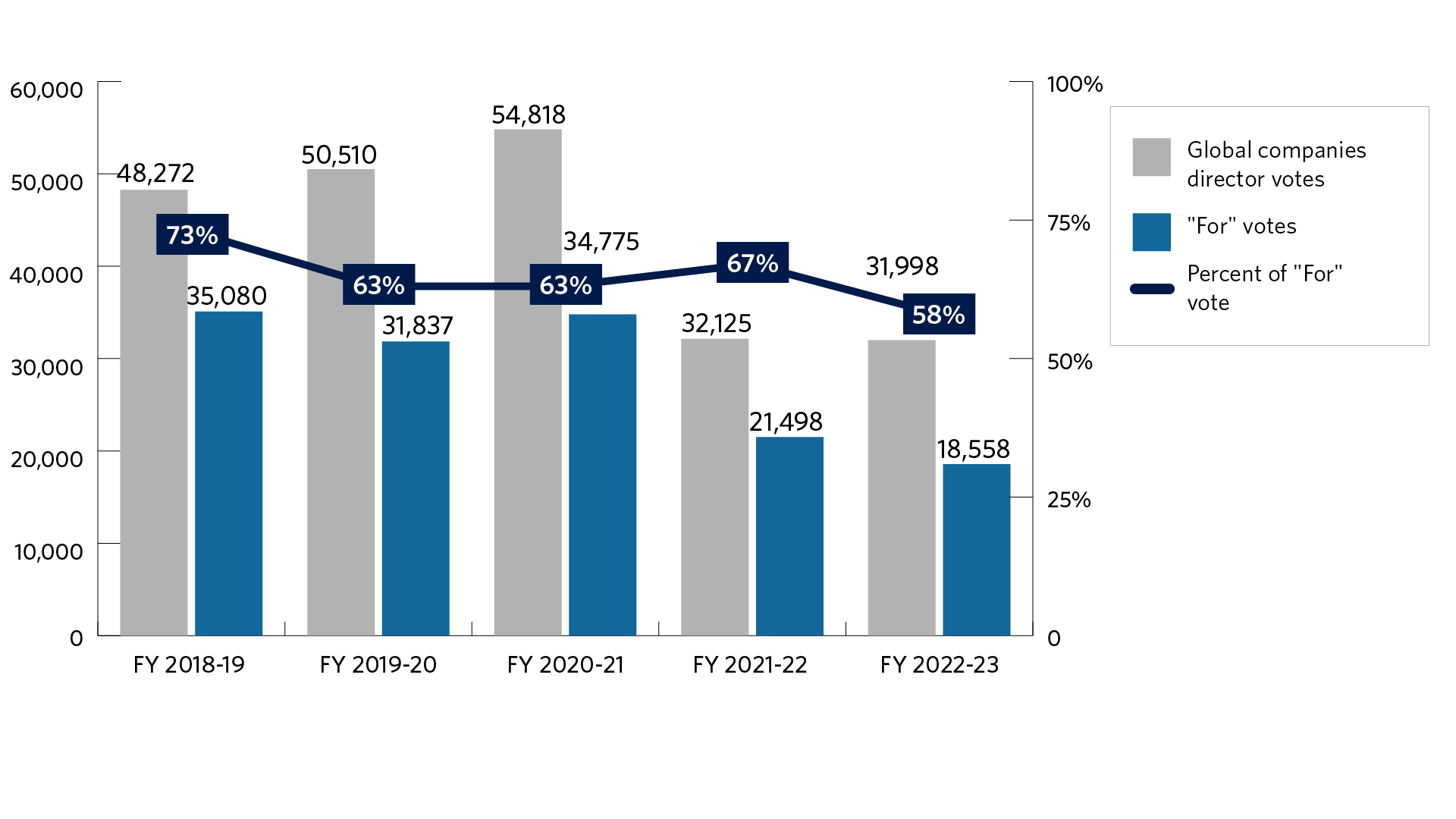

- CalPERS support of directors decreased from 67% in 2022 to 58% in 2023 (see Figure 1: Global Director Votes) driven by a sharp decline in support of international directors, while support for United States directors held relatively steady.

- The decrease internationally, from 63% to 52%, was due to CalPERS’ decision to raise its standard for board independence in the Japan market from 33% to 50%.

- CalPERS also increased its votes against executive compensation where pay issues were observed, voted on a record-high number of shareowner proposals in Global Equities, and increased the total of environmental proposals that it supported by nearly 50%.

"CalPERS believes that high-quality corporate boards should be comprised of mostly independent directors and be diverse with an appropriate balance of skills, expertise, and tenure," said Drew Hambly, CalPERS Global Equities Investment Director. "When CalPERS votes against a director in an uncontested election, it is a signal to the board that there is some aspect of governance or board oversight that we believe needs improving."

CalPERS actively participates in proxy voting as one of the world's largest institutional shareholders in an effort to influence a company’s corporate governance practices and ensure positive returns on behalf of its more than 2 million members.

"These votes generally lead to productive engagements on important issues like climate-related risks, board independence, and executive compensation which help CalPERS deliver on its fiduciary duty," Hambly said.

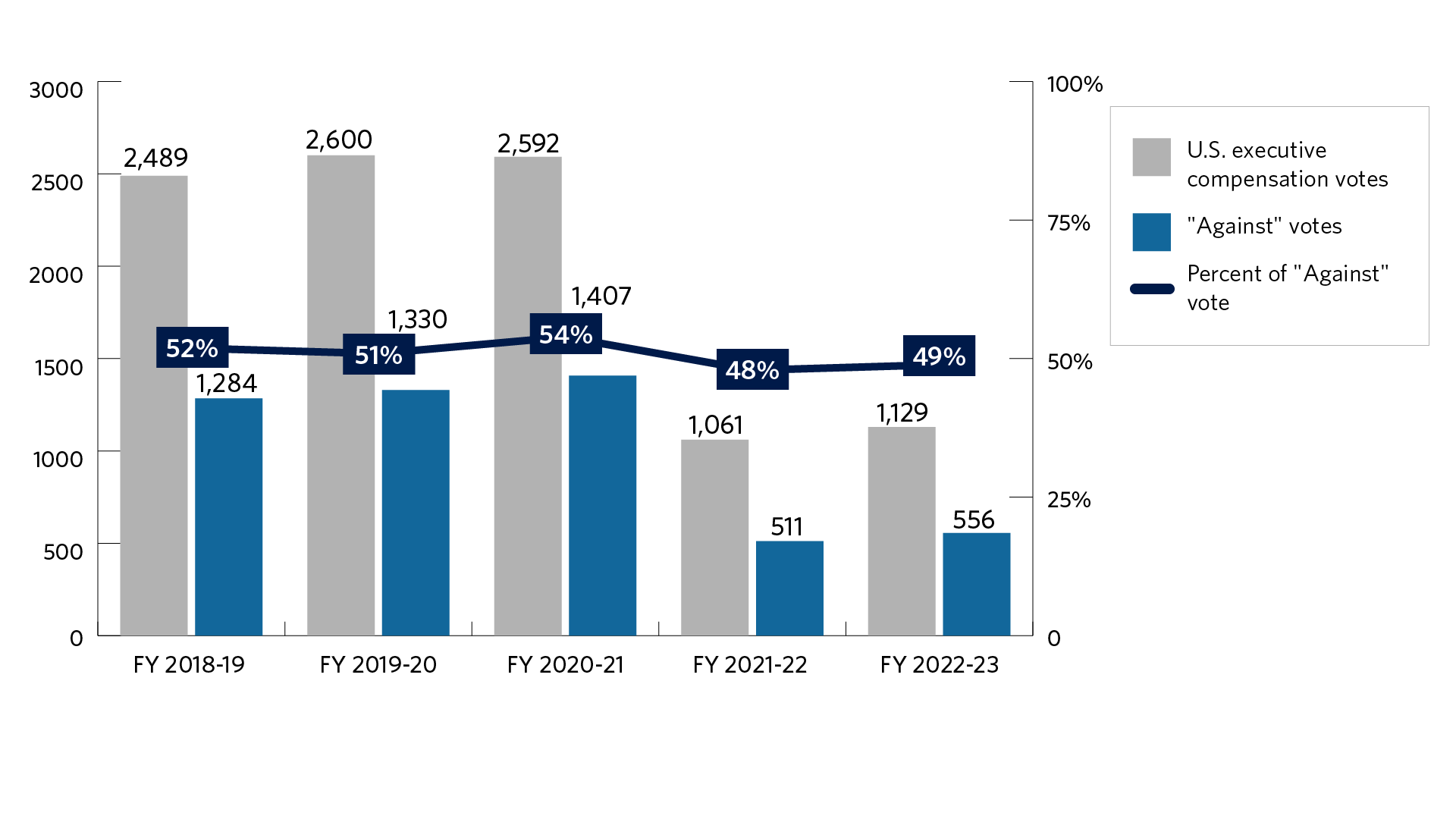

During 2023, CalPERS increased its level of opposition for advisory votes on executive compensation to 49% from 48% the prior year (see Figure 2: United States Executive Compensation Votes). CalPERS opposed these proposals due to issues such as: misalignment among pay and performance, short performance and/or vesting periods for long-term incentives, one-time awards without sufficient justification or performance periods, or a lack of comprehensive disclosure.

"We believe there are many structural issues in U.S. pay compensation plans, like short vesting for equity awards, that could be improved in the U.S. market," Hambly said.

Finally, CalPERS voted on a record-high 589 shareholder proposals that dealt with environmental, social, and governance topics (ESG), exhibiting an increase of 22% over the previous year.

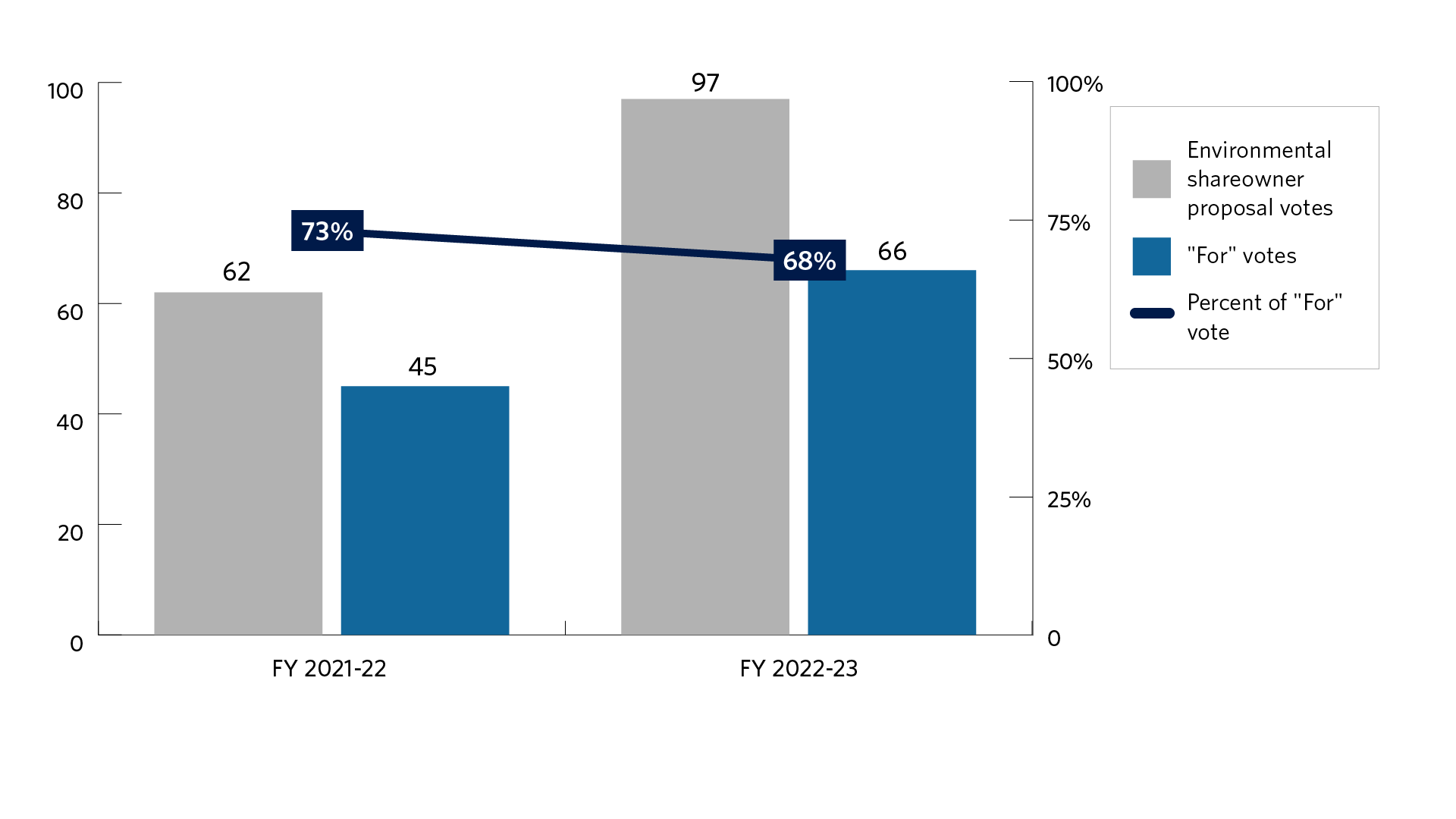

Included in that total, CalPERS boosted its votes in favor of environment-specific shareowner proposals that mitigated risk from 45 proposals in the prior year to 66 in 2023, an increase of 47% (see Figure 3: United States Environment Shareowner Proposals).

Overall, support for environmental proposals declined slightly, 73% to 68%, for a variety of reasons such as: proposals that were too restrictive, had already been implemented by the company, or were not aligned with CalPERS Governance & Sustainability Principles (PDF) and Proxy Voting Guidelines (PDF).

About CalPERS

For more than nine decades, CalPERS has built retirement and health security for state, school, and public agency members who invest their lifework in public service. Our pension fund serves more than 2 million members in the CalPERS retirement system and administers benefits for more than 1.5 million members and their families in our health program, making us the largest defined-benefit public pension in the U.S. CalPERS' total fund market value currently stands at approximately $484 billion. For more information, visit www.calpers.ca.gov.