Service Credit (Time Worked)

You earn service credit for each year or partial year you work for a CalPERS-covered employer. It accumulates on a fiscal year basis (July 1 through June 30) and is one of the factors we use to calculate your future retirement benefits.

Your CalPERS retirement benefits are based on your:

- Age at retirement

- Highest salary for either a 1- or 3-year period, depending on your employer's contract

- Years of service credit

To earn a full year of service credit during a fiscal year, you must work at least:

- 1,720 hours (hourly pay employees)

- 215 days (daily pay employees)

- 10 months full time (monthly pay employees)

Service credit for retirement purposes may differ from the service credit used by your employer for accrual of leave time. Refer to your Annual Member Statement for details.

State Second Tier

If you have State Second Tier service and have not yet retired, you may elect to convert your State Second Tier service credit to the State First Tier retirement formula. Learn more about converting from State Second Tier.

Purchase Options

We offer a variety of service credit purchase options to eligible members. Review this information carefully to see if you might qualify to purchase additional service credit. To get an idea of what you may be eligible to purchase and the potential cost, log in to your myCalPERS account and request to purchase service credit (see Steps to Request Service Credit

below for more information).

As a result of the Public Employees' Pension Reform Act of 2013 (PEPRA), the Additional Retirement Service Credit (ARSC) is no longer a service credit purchase option.

What are the advantages to purchasing service credit early in your career?

- Planning for your future. Your retirement benefit estimate will be calculated using any service credit you've purchased. The sooner you purchase, the more accurate your estimate will be.

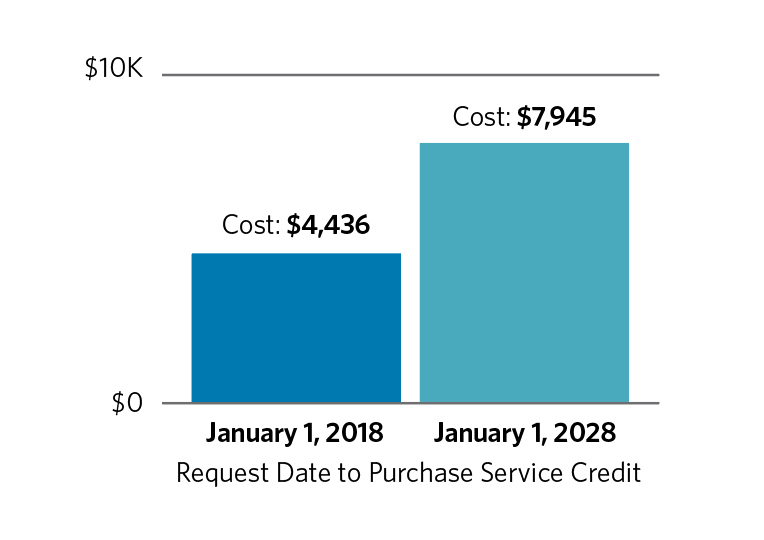

It's less expensive. As your salary increases, the cost to purchase service credit can increase as well. In addition, interest may accrue as time passes from the dates being requested to the date of purchase. This means the longer you wait to request cost information, the more expensive it could be. The table below illustrates the cost difference when purchasing service credit sooner rather than later:

Figure 1: Service Prior to Membership Example

If you were a first-time state miscellaneous or industrial employee hired between August 11, 2004 and June 30, 2013, you may have Alternate Retirement Program (ARP) time administered by the California Department of Human Resources (CalHR). ARP members began earning CalPERS service credit after the first 24 months of state employment. ARP isn't included in your total CalPERS service credit until it's transferred or purchased.

You had a one-time opportunity to receive CalPERS service credit for the actual amount of time worked during your two years of ARP participation. You were eligible to make this decision during a three-month election period.

Table of impacts Months of State Employment Impacts to ARP Time 1-24 The first 24 months of employment is your ARP period. You are not paying contributions to CalPERS or earning service credit 25-34 Starting month 25 and forward, you are moved from ARP to CalPERS membership. You begin paying retirement contributions to CalPERS and earning service credit. 47-69 Once your 47th month arrives, you will have a 3-month election period to transfer the ARP funds to CalPERS, receive a lump sum distribution of the ARP funds or transfer the ARP funds to a Savings PLus 401(K) at CalHR. - If you didn't elect to convert your ARP time to CalPERS service credit, you may be eligible to purchase this service credit now.

- If you previously separated during your ARP period and received a distribution of your ARP contributions from CalHR, you may be eligible to purchase that ARP time as well. Contact us for more information.

Requirements

- You can purchase all unconverted ARP service starting on the first day of your 50th month following your CalPERS membership date.

- You must purchase all unconverted ARP time for which you are eligible, based on the actual amount of time worked during your two years of ARP. You can't purchase partial service credit or only purchase service credit for a specific employment period.

- You can't purchase this service credit if you already elected to convert your ARP time to CalPERS service credit or if you are retired.

- You'll need to view the service credit section of your Annual Member Statement to know how much unconverted ARP time you have.

Cost

The cost is calculated using the present value cost method, which is based on:

- Your highest monthly full-time pay rate

- Estimated future final compensation

- Projected retirement benefit increase

Determining the increase to your future benefits involves a number of actuarial assumptions including the projected age at retirement, life expectancy, salary inflation, and the assumed rate of return on investments. These assumptions are the same as those used to ensure all our benefits are adequately funded.

Base Realignment and Closure (BRAC) Firefighter Service Credit pertains to a permanent career civilian federal firefighter or permanent career state firefighter who had their services terminated at a California federal military installation.

Eligibility

Active members must meet all of the following:

- You were a permanent career civilian federal firefighter or permanent career state firefighter in a position whose principal duties consisted of active fire suppression or law enforcement.

- Service was terminated as a direct consequence of the closure, downsizing, or realignment of a federal military institution.

- You're currently an active firefighter with a CalPERS-covered public agency.

- Your employer contracts for this service credit purchase option.

You can't purchase service credit in CalPERS if:

- You're vested in Federal Employees' Retirement System (FERS) or Civil Service Retirement System (CSRS).

- You're retired or inactive.

- You have previously purchased this service credit and received credit for this time under another retirement system.

Requirements

You must be able to provide us with documentation that you were working at a California federal military installation that was terminated due to BRAC and provide certification of your dates worked.

Cost

The cost is calculated using the pay and contribution rate method, which is based on your pay rate and the contribution rate on the date you became a CalPERS member (after the service was rendered), and interest will be compounded annually until you elect to make the purchase.

Time spent working for a CalPERS-covered employer under the Comprehensive Employment and Training Act before becoming a CalPERS member is known as CETA. Fellowship is time spent working under the Assembly, Senate, Executive, or Judicial Administration Fellowship program before becoming a CalPERS member.

Eligibility

If you're now a CalPERS member, you may purchase service credit if you meet the following:

- You worked under CETA for a federal- or state-sponsored program such as the Public Employee Program, Public Service Employment, Disabled Veterans' Outreach Program, Public Service Employment Program, or Cal Esteem from 1973 to 1982.

- You worked under the Assembly, Senate, Executive, or Judicial Administration Fellowship program from 1973 to 1982.

You can't purchase service credit in CalPERS if:

- The agency where the service was earned does not currently have a contract with CalPERS.

- You're retired.

- Your service is excluded by law or by the employer's contract with CalPERS.

Requirements

You must be able to provide us with documentation certifying your dates and hours worked.

Cost

The cost is calculated using the present value method, which is based on:

- Your highest monthly full-time pay rate

- Estimated future final compensation

- Projected retirement benefit increase

Determining the increase to your future benefits involves a number of actuarial assumptions including the projected age at retirement, life expectancy, salary inflation, and the assumed rate of return on investments. These assumptions are the same as those used to ensure all our benefits are adequately funded.

Layoff is time spent away from work as a result of a formal layoff action.

Eligibility

You may purchase layoff service credit if you meet all of the following requirements:

- The layoff period must have been on or after January 1, 1981.

- You may purchase a maximum of one year for each layoff period.

- You must currently be active with the layoff employer.

- You must elect to purchase this service within three years of returning to work or within three years of the effective date your employer adds this option to its contract.

- You must have been a full-time employee prior to being laid off.

- You must have been laid off from a CalPERS-covered public agency employer with this option in its contract.

- You must have returned to full-time, CalPERS-covered employment with the layoff employer within 12 months of being laid off.

You can't purchase layoff service credit if:

- You're retired.

- Your employer did not contract for this option.

- You didn't work full-time prior to being laid off.

Cost

The cost is calculated using the pay and contribution rate method, which is based on your pay rate and the contribution rate on the date you returned to employment (after the layoff), and interest will be compounded annually until you elect to make the purchase.

A leave of absence is time during which your employer authorized you to be absent from some or all of your duties. Leave of absence types include:

- Educational

- Maternity/Paternity

- Sabbatical

- Serious illness

- Service

- Temporary disability

Each leave of absence period must be requested separately.

Eligibility

You may be able to purchase service credit for a leave of absence if you're an active or inactive CalPERS member. Eligibility depends on the type of leave and employer contract. You must have been a CalPERS member at the time you took the leave of absence.

You can't purchase service credit for a leave of absence if:

- The leave was not approved by your employer.

- Your leave of absence was not for one of the types listed above.

- You're retired.

Requirements

An educational leave is time off to pursue higher education.

- You can purchase a maximum of two years of service credit even if the combined total of your educational leaves exceeds two years.

- You must be a state or California State University (CSU) employee both before and on your return from the leave.

Maternity/Paternity leave is time off after the birth or adoption of a child.

- You can purchase up to one year of service credit per leave of absence period.

- You can't purchase service if you've already earned a full year of credit (10 full-time months) during that fiscal year (July 1 through June 30).

- You must return to active CalPERS-covered employment at the end of the approved leave and remain in CalPERS-covered employment at least the same amount of time as the leave of absence.

A sabbatical leave is time off to pursue personal academic career goals.

- There is no maximum amount of service credit you can purchase.

- You must have been partially compensated during the leave of absence.

- You must return to active CalPERS-covered employment at the end of your approved leave of absence.

A serious illness leave is time off because of your own serious illness or injury.

- There is no maximum amount of service credit you can purchase.

- You must return to active CalPERS-covered employment at the end of the approved leave.

- Your employer must certify you were approved for a leave because of your own serious illness or injury.

Service leave is time off to serve with a college or university; local, state, federal, or foreign government agency; or certain nonprofit organizations.

- You can purchase a maximum of two years of service credit for each service leave.

- You must return to active CalPERS-covered employment with the employer from which the leave was granted, or immediately retire after your leave of absence. If the leave was from a CSU, the employer you return to could include any campus within the CSU system.

Temporary disability leave is time off while receiving temporary disability payments from a workers' compensation carrier because of a job-related injury or illness.

- There's no limit to the amount of service credit you can purchase.

- Forward the Worker’s Compensation Certification (PDF) to the appropriate carrier that provided the temporary disability benefits and upload the completed form to myCalPERS within 45 days of submitting your request electronically.

Cost

Non-Temporary Disability

The cost for all non-temporary disability leave of absence types is calculated using the present value method, which is based on:

- Your highest monthly full-time pay rate

- Estimated future final compensation

- Projected retirement benefit increase

Determining the increase to your future benefits involves a number of actuarial assumptions, including the projected age at retirement, life expectancy, salary inflation, and the assumed rate of return on investments. These assumptions are the same as those used to ensure all our benefits are adequately funded.

Temporary Disability

The cost for temporary disability leave of absence is calculated using the pay and contribution rate method, which is based on your pay rate and contribution rate on the date you return to employment (after the leave), or the date prior to your leave if you immediately retired. Interest will be compounded annually until you elect to make the purchase.

A military leave of absence is time off work to serve in the uniformed services.

Eligibility

Service credit may be posted to your account at no cost to you, if you:

- Were granted a military leave of absence.

- Entered active duty military service within 90 days of leaving your CalPERS-covered employment.

- Returned to CalPERS-covered employment or were placed on a state civil service re-employment list within six months of your discharge date.

If you returned to employment after the six-month period, you may be eligible to purchase service credit. There are no limitations on the amount of service credit that can be credited or purchased.

Cost

If there is no member cost for your military leave of absence service credit, the service credit is posted to your retirement account at no cost. You receive the benefits of this service credit when you retire or upon your death.

If you only qualify for military leave of absence with a member cost, the cost is based on your contributions due for the period of the absence using your:

- Pay rate

- Exemption amount (if applicable)

- Contribution rate in effect at the time of the leave

No interest is included in the lump-sum cost.

If you have a cost for your military leave of absence service credit, you may choose to purchase less than your eligible service credit total.

If you served in active military duty prior to CalPERS-covered employment, you may be eligible to purchase service credit.

Eligibility

You may purchase a maximum of four years of military service credit if you meet one of the eligibility requirements as follows:

- A current, former, or retired member of a CalPERS-covered employer that contracts for this option.

- A current or retired state or school member.

You can't purchase military service credit if you:

- Are receiving military retirement pay based on 20 years of active military service.

- Have received military service credit in any other retirement system.

Requirements

Active members must meet all of the following:

- You have a minimum of one year of earned CalPERS service for each year of military service credit requested (four-year maximum).

- You served in active military duty at least one year.

- You weren't dishonorably discharged.

Retired members must meet all of the following:

- You retired on or after December 31, 1981.

- You retired with at least one year of CalPERS service credit for each year of military service requested.

- You retired within 120 days of separation from a qualifying employer. The increase in benefits will be effective once CalPERS receives your election and will not be retroactive to your retirement date.

- You served in active military duty at least one year.

Current or former employees of a public agency employer that contracts for this option must meet all of the following:

- Your purchase could include up to six months of service credit.

- You served in active military duty.

Retirees of a public agency employer that contracts for this option must meet all of the following:

- You served in active military duty.

- You retired within 120 days of separation from a qualifying employer. The increase in benefits will be effective once we receive your election and will not be retroactive to your retirement date.

Cost

The cost is calculated using the present value method, which is based on:

- Your highest monthly full-time pay rate

- Estimated future final compensation

- Projected retirement benefit increase

Determining the increase to your future benefits involves a number of actuarial assumptions including the projected age at retirement, life expectancy, salary inflation, and the assumed rate of return on investments. These assumptions are the same as those used to ensure all our benefits are adequately funded.

You must include supporting documentation (e.g., copy of military discharge documents, DD-214, certification of military service record, etc.) for each active duty military period to us when your request is submitted.

For information on how to obtain a copy of your discharge document(s), visit the U.S Department of Veterans Affairs.

Optional member service is time spent working in certain exempt, appointed, or elected positions that allow employees the option of joining CalPERS. There are no limits on the amount of time that can be purchased.

Eligibility

You may be eligible to purchase service credit for optional member service if you are (or elect to become, if eligible) a CalPERS member.

The following employees are considered optional members:

- A state employee who was appointed by the Governor, Lieutenant Governor, Attorney General, Controller, Secretary of State, Treasurer, or Superintendent of Public Instruction and is exempt from civil service.

- An employee of the California State Senate or Assembly whose wages are paid from funds controlled by either body.

- Some officials elected or appointed to a fixed term of office with a city or county (this may include city attorneys and elected/appointed officials of schools and contracting agencies; eligibility is determined by the dates of your term of office).

You can't purchase service credit if:

- You're retired

- Your position is excluded by the employer's contract

Requirements

You must meet both of the conditions below:

- You're a CalPERS member

- You're an optional member on the date you request your cost information

If you formerly held an optional position and are now a CalPERS member, you may still be able to purchase your former service.

Cost

The cost is calculated using the pay and contribution rate method, which is based on your pay rate and the contribution rate on the date you became a CalPERS member (after the service was rendered), and interest will be compounded annually until you elect to make a purchase.

If you're an active or inactive CalPERS member, you may be eligible to purchase credit for up to three years of service in the Peace Corps, AmeriCorps*VISTA (Volunteers In Service To America), or AmeriCorps.

Eligibility

You may purchase Peace Corps, AmeriCorps*VISTA, or AmeriCorps service credit if you are either:

- A public agency member (if your employer contracts with CalPERS to provide this option)

- A state or school active or inactive member

You can't purchase Peace Corps, AmeriCorps*VISTA, or AmeriCorps service credit if:

- You're already retired.

- You don't have certification of your dates of service.

- Your public agency employer does not include this option in its contract.

Requirements

You must be able to provide CalPERS with documentation certifying your dates of service. Request a certification letter from the Peace Corps or AmeriCorps.

Cost

The cost is calculated using the present value method which is based on:

- Your highest monthly full-time pay rate

- Estimated future final compensation

- Projected retirement benefit increase

Determining the increase to your future benefits involves a number of actuarial assumptions including the projected age at retirement, life expectancy, salary inflation, and the assumed rate of return on investments. These assumptions are the same as those used to ensure all our benefits are adequately funded.

Prior service is time worked for an employer before they contracted with CalPERS. A contracting agency may provide this service or a percentage of this service at employer cost.

Eligibility

You may receive or purchase service credit for prior service if:

- You're an active or inactive CalPERS member.

- Your employer contracts for this service credit option.

Requirements

If you worked for a CalPERS-covered employer Limitations/restrictions vary by agency. Some agencies may require that you be employed on the effective date of the contract. Check with your personnel office. The agency must have contracted for this option.

Cost

This benefit depends on the specific terms of your employer's contract with CalPERS. Depending on the contract, you could be:

- Credited at no cost with all of the service credit you would have earned.

- Credited at no cost with some of the service credit you would've earned and be given the option to purchase the rest.

- Given the option to purchase all of the service credit you would've earned.

- If there is a cost associated to the service, the cost is calculated using the pay and contribution rate method, which is based on your pay rate and the contribution rate on the date you became a CalPERS member (after the service was rendered), and interest will be compounded annually until you elect to make the purchase.

If you were previously a CalPERS member, left your CalPERS-covered employer, and took a refund of your contributions and interest; you may be eligible to redeposit these funds and restore those years of service credit.

Eligibility

You may redeposit funds you previously withdrew if you're:

- A member of a reciprocal retirement system.

- A member whose former spouse or registered domestic partner received a portion of your account as part of a community property settlement and took a refund of their account.

- An active CalPERS member.

- An inactive CalPERS member with service credit still on your account.

You can't redeposit if you:

- Are now an active or inactive CalPERS member, but the agency you worked for does not currently contract with CalPERS or a qualifying reciprocal system.

- Are retired.

- Have previously purchased this service credit and received credit for this time under another retirement system.

- Left CalPERS-covered employment, withdrew your contributions, and currently not a member of CalPERS or a qualifying reciprocal system.

- Were enrolled in the Alternate Retirement Program (ARP) and received a distribution of those funds from the California Department of Human Resources (see the ARP purchase option for eligibility).

Requirements

If you withdrew contributions for one or more membership periods in one withdrawal, you must redeposit for all in one redeposit election.

If you made separate withdrawals of your contributions for one or more membership period(s), you may redeposit in one redeposit election or in separate redeposit elections. If you choose to make separate redeposit elections, you must begin with the most recent withdrawal and end with the oldest.

Cost

CalPERS calculates the amount of the withdrawal plus interest (compounded annually to the end of the current pay period).

You may be eligible to purchase service credit if you worked for a CalPERS-covered employer before you became a CalPERS member.

Eligibility

You may purchase service credit if you:

- Are an active or inactive CalPERS member.

- Worked for a CalPERS-covered employer as a seasonal, temporary, part-time, or intermittent employee, but were not a CalPERS member.

You can't purchase CalPERS service credit if:

- The agency where the service was earned does not currently have a contract with CalPERS.

- You're retired.

- You worked at a school in a certificated position (you may be eligible to purchase the service through the California State Teachers' Retirement System instead).

- You worked at the University of California after October 1, 1963 (you may be eligible to purchase service with the University of California Retirement Plan instead).

- Your service is excluded by law or by the employer's contract with CalPERS.

Requirements

Once you submit your SPM request in myCalPERS, the employer for whom you worked during the period requested will be required to provide the necessary payroll details (i.e. pay rate, earnings, hours worked, etc.) for the SPM period electronically in myCalPERS. Work with your employer to ensure they provide the requested certification in a timely manner.

Cost

The cost is calculated using the pay and contribution rate method, which is based on your pay rate and the contribution rate on the date you became a CalPERS member (after the service was rendered), and interest will be compounded annually until you elect to make the purchase.

You may be eligible to request to purchase service credit online*. We recommend you request to purchase service credit early in your career because the cost will be lower, and you can pay off your lump sum balance in full prior to your retirement to maximize your benefit increase.

To request online, log in to myCalPERS. Go to the Retirement tab, select Service Credit Purchase followed by the Search for Purchase Options button. Here, you will be prompted to answer a series of questions to help determine which service credit types you may be eligible to purchase. You will also be asked to provide employment and service information for the requested period. Once all required information has been completed, you can view the estimated cost for any available purchase options and submit your request for review.

There are several benefits to requesting your service credit purchase online, including:

- Ability to easily submit any additional required documents online.

- Ability to monitor the status of your request from start to finish.

- Automatically receive the estimated cost information for eligible service credit purchases.

- Easily and securely submit your request at your convenience, 24 hours a day.

- Increase in process efficiency.

- Reduced processing time for requests.

*Note: At this time, Retired Military service credit requests are not able to be submitted online.

Once you submit your service credit purchase request, you can view the status through your myCalPERS account. Go to Retirement, select Service Credit Purchase and view Your Requests, where you can see your status and request date.

If certification is needed from an employer or reciprocal agency, you and the agency will be notified electronically. The agency will have 30 days to provide the required certification. If no certification is provided within the 30-day timeframe, the request will expire and will need to be resubmitted. Work with your employer to ensure the certification is submitted prior to the expiration date.

Once we receive all required documents and determine eligibility, the cost details will be available in myCalPERS for your review within 60 days.

Payment Options

Once you've determined your service credit type, you can view Payment Options to learn about ways to purchase your service credit.

Videos